Have a Question?

Market Report

Martha’s Vineyard Real Estate Market Update is a service offered by Tea Lane Associates. Tea Lane Associates updates Martha's Vineyard real estate sales transactions on a weekly basis and posts reports and charts throughout the year for your review, including info on all homes and land sales on the island. Please let us know if you have any questions or would like more detailed analysis for properties in a specific town or price range. We have much more information to share with you on the Martha's Vineyard Real Estate market.

2025 MID-YEAR REPORT | 2024 MARKET REVIEW | KEY MARKET STATISTICS | 2024 TEA LANE HIGHLIGHTS

RECENT NEWS

| 12/8/25 | 14 Rebekahs Way | West Tisbury | $1,875,000 | Leahy | Kleinman/Berstein |

| 12/8/25 | 78 Whalers Walk | Edgartown | $1,675,000 | Davis | Delotto |

| 12/8/25 | 6 Sachem Way | Oak Bluffs | $970,000 | Minor | Balbino |

| 12/9/25 | 79 Beach Rd#30 | Tisbury | $630,000 | Finklestein | Kowry-Jones |

| 12/9/25 | 110 Fifth St No | Edgartown | $3,120,000 | Solis | Inklove LLC |

| 12/9/25 | 1 Muskoday Way | Edgartown | $3,300,000 | Herzig | 1 Muskoday Way Nom Tr |

| 12/10/25 | 10 Wood Duck Way | Oak Bluffs | $2,250,000 | Harker | Harriet G Prop LLC |

| 12/12/25 | 1 Jessie Leigh Mitchell Way | Oak Bluffs | $1,000,000 | Speight | Knott |

| 12/12/25 | 36 Tashmoo Ave | Tisbury | $2,637,500 | McDonnell | Tashmoo MV Realty Tr |

| 12/12/25 | 1 Edgewood Dr | Edgartown | $1,280,000 | Mulhall | Willett/Kruse/Lopes |

Martha's Vineyard MID-YEAR 2025 Real Estate Market Report

In the first half of 2025, the Martha’s Vineyard real estate market grew at a healthy pace compared to the first half of 2024. The number of transactions increased 9% from 142 in the first half of 2024 to 155 in the first half of 2025. Although this metric is improved, it is important to keep in mind that 2024 had the lowest number of transactions in the first half of the year since 2009 (which was immediately following the global economic crisis of 2008 caused by the housing bubble). Dollar volume in the first half of 2025 grew 12% from $271mm in the first half of 2024 to $304mm in the first half of 2025. Average price increased 3% from $1.91mm in the first half of 2024 to $1.96mm in the first half of 2025. Although average price increased, average price is still down from its peak in the first half of 2024 where the average transaction price was $2.061mm. The first half of 2025 is healthy compared to the first half of 2024 but the first half of 2024 was a very slow market.

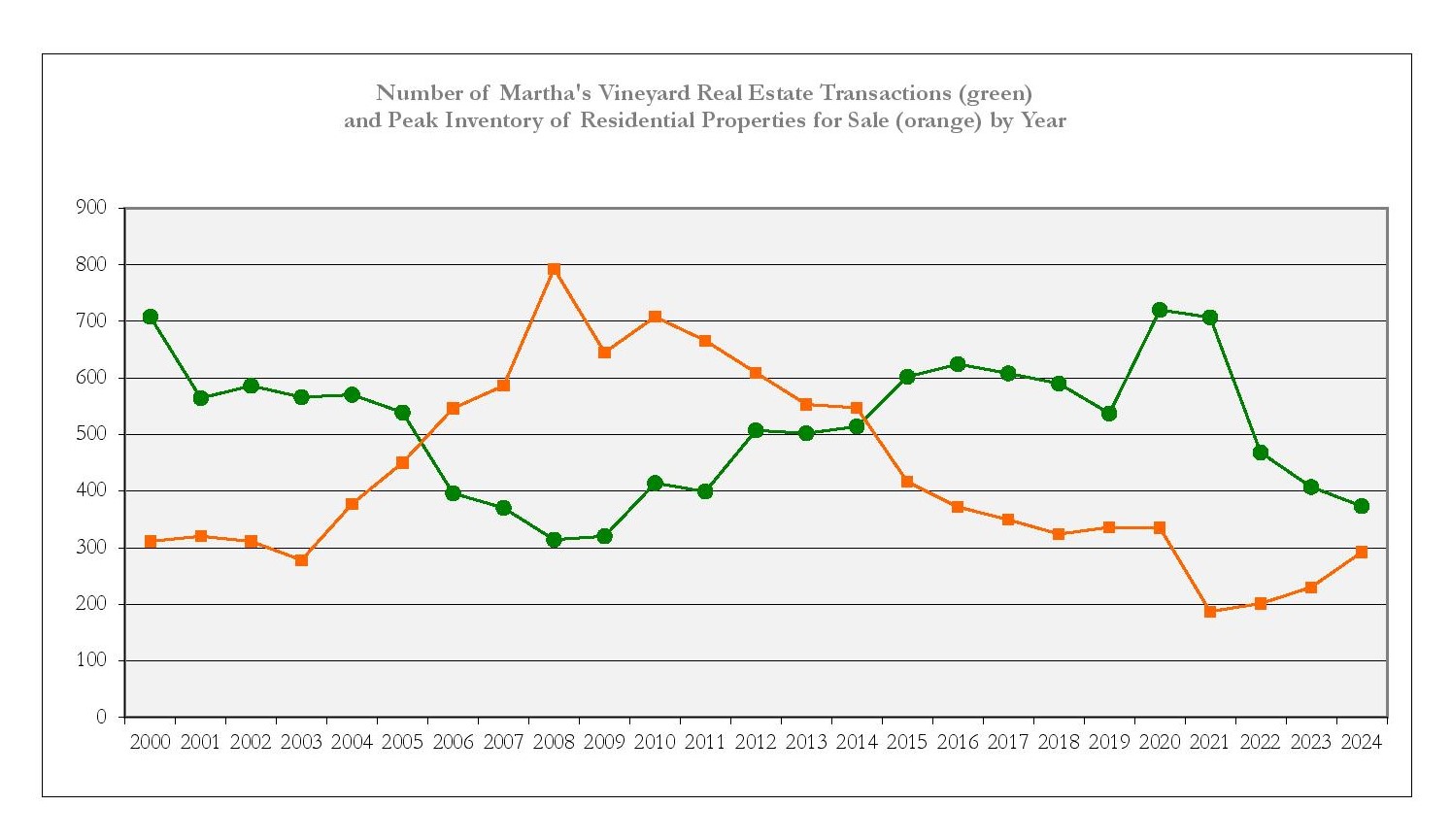

Inventory continued to tick up in the first half of 2025. The inventory level at mid-year 2025 was 350 properties which is significantly higher than 262 at mid-year 2024 and 186 at mid-year 2023, but still lower than mid-year 2020 (just before real estate activity began to increase due to COVID factors) which was 396 properties.

All towns experienced varying growth in dollar volume except Tisbury and West Tisbury in the first half of 2025. The decline of dollar volume in these towns was primarily due to the lack of high-end sales in these two towns during the timeframe although Tisbury also had 12 fewer transactions in the first half of 2025 compared with 2024 (26 transactions versus 38). The high-end overall on the island held steady at 16 sales over $4mm in the first half of 2025 compared with 15 sales in the first half of 2024.

At mid-year 2025, with higher inventory and historically sluggish transactions, the shift from the Seller’s market of the COVID era to a Buyer’s market is well underway. Although prices seem to be holding high, only strong activity in the second half of the year will keep them there. Although we do not expect prices to slide dramatically, we do expect some softening and have witnessed price reductions occurring already during the prime mid-summer season. For those who are considering buying or selling, understanding this market can be challenging. For more information, give us a call.

Martha’s Vineyard 2024 Real Estate Market Review

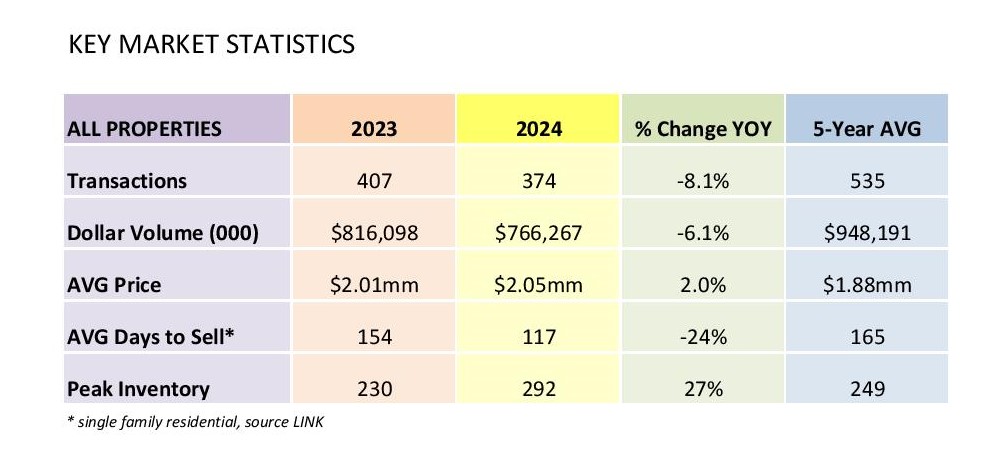

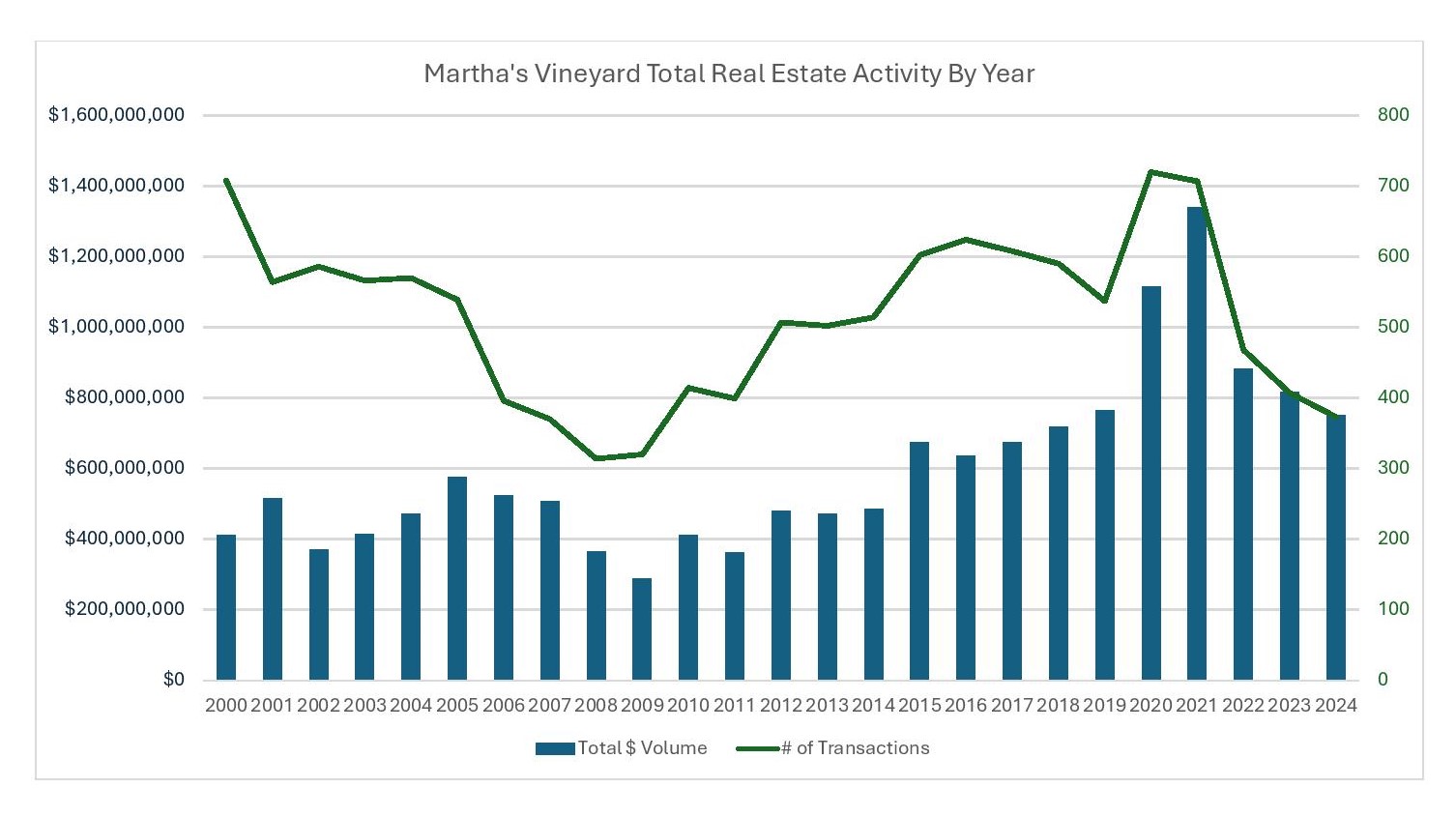

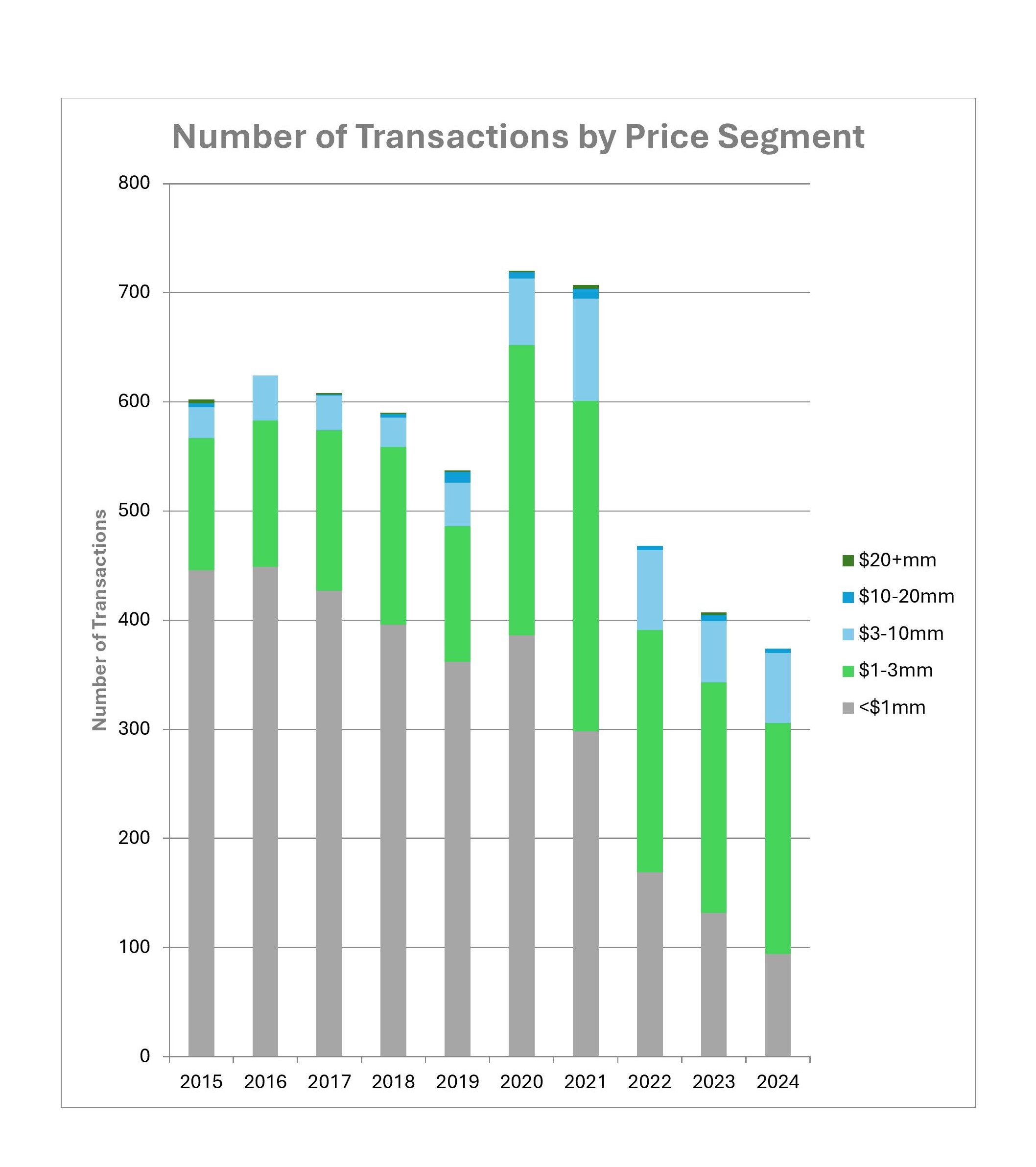

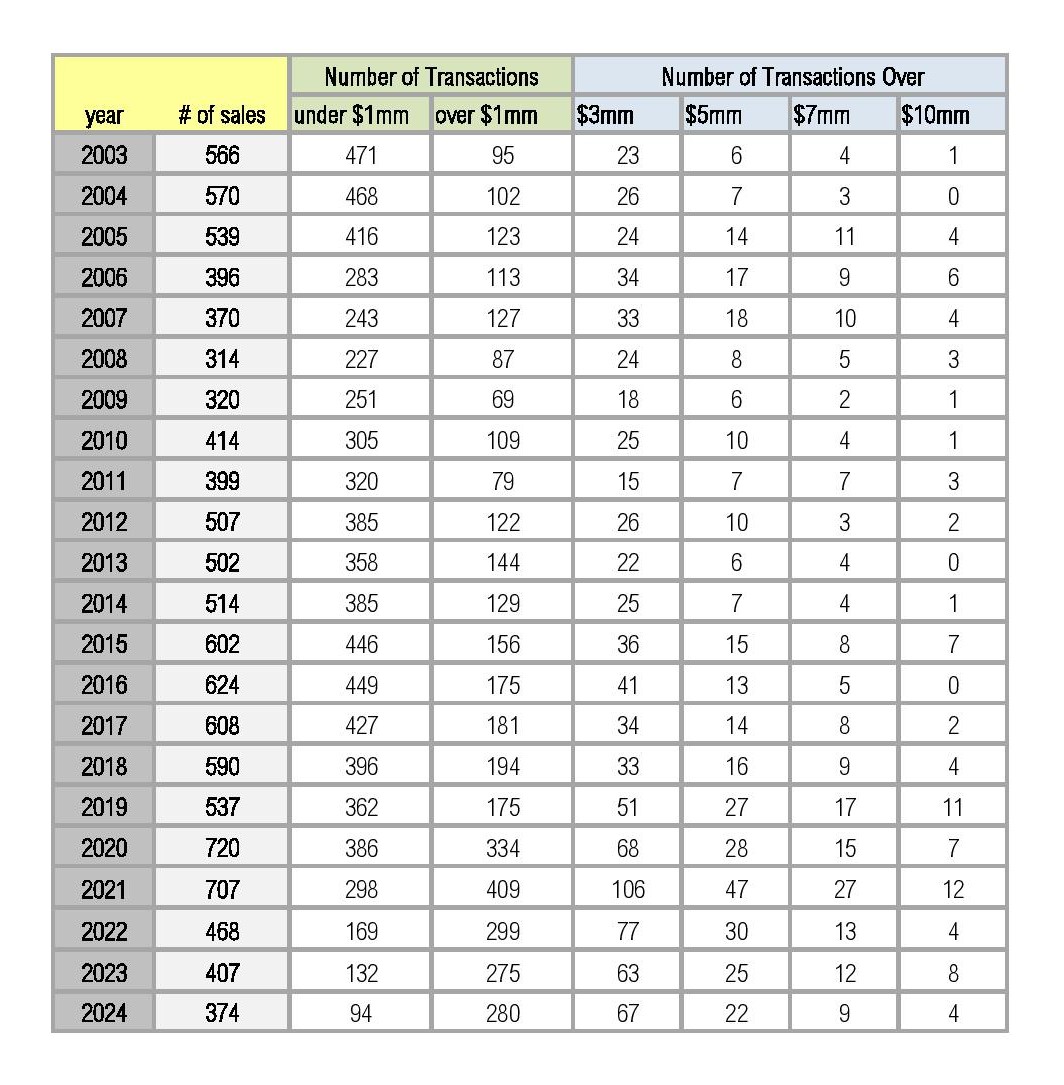

The Martha’s Vineyard real estate market continued to soften in 2024. The number of total transactions fell 8.1% from 407 transactions in 2023 to 374 transactions in 2024. Dollar volume decreased 6.1% from $817mm in 2023 to $766mm in 2024. Average price increased modestly 2.2% from $2.01mm in 2023 to $2.05mm in 2024.

To give a broader perspective on these numbers, 374 transactions is the lowest activity level since 2009 for this market. The dollar volume of $766mm takes us back to the 2019 level, prior to the COVID boom. But average price continued to climb to another record setting high level in 2024.

Residential sales in 2024 accounted for 86% of overall market dollar volume and 81% of transactions. Looking at residential properties specifically (including condo sales), transactions and dollar volume declined similarly to the overall market (both down 7%), while average price of residential properties fell modestly from $2.196mm in 2023 to $2.176mm in 2024 (a 1% decline). Median price remained essentially flat from $1.550mm in 2023 to $1.555mm in 2024. 2024 is the first time average price of residential property has fallen since the pre-COVID boom.

The downturn in average price of residential property, albeit just 1%, could be a significant marker of a shift in the real estate market on the island. The downward trend of total market volume and number of transactions has been occurring for three years now, since the COVID peak in 2021, but average price of residential property was defiantly continuing to climb in 2022 (up 2%) and 2023 (up 7%). 2024 marked the end of that climb. In 2024, all three of these indicators (dollar volume, number of transactions and average price of residential property) posted declines.

Note that average price of all property sales was up 2.2% in 2024. Average price of all properties year over year has not decreased for the past 10 years (but was flat in 2022).

INVENTORY AND PRICING TRENDS 2020-2024

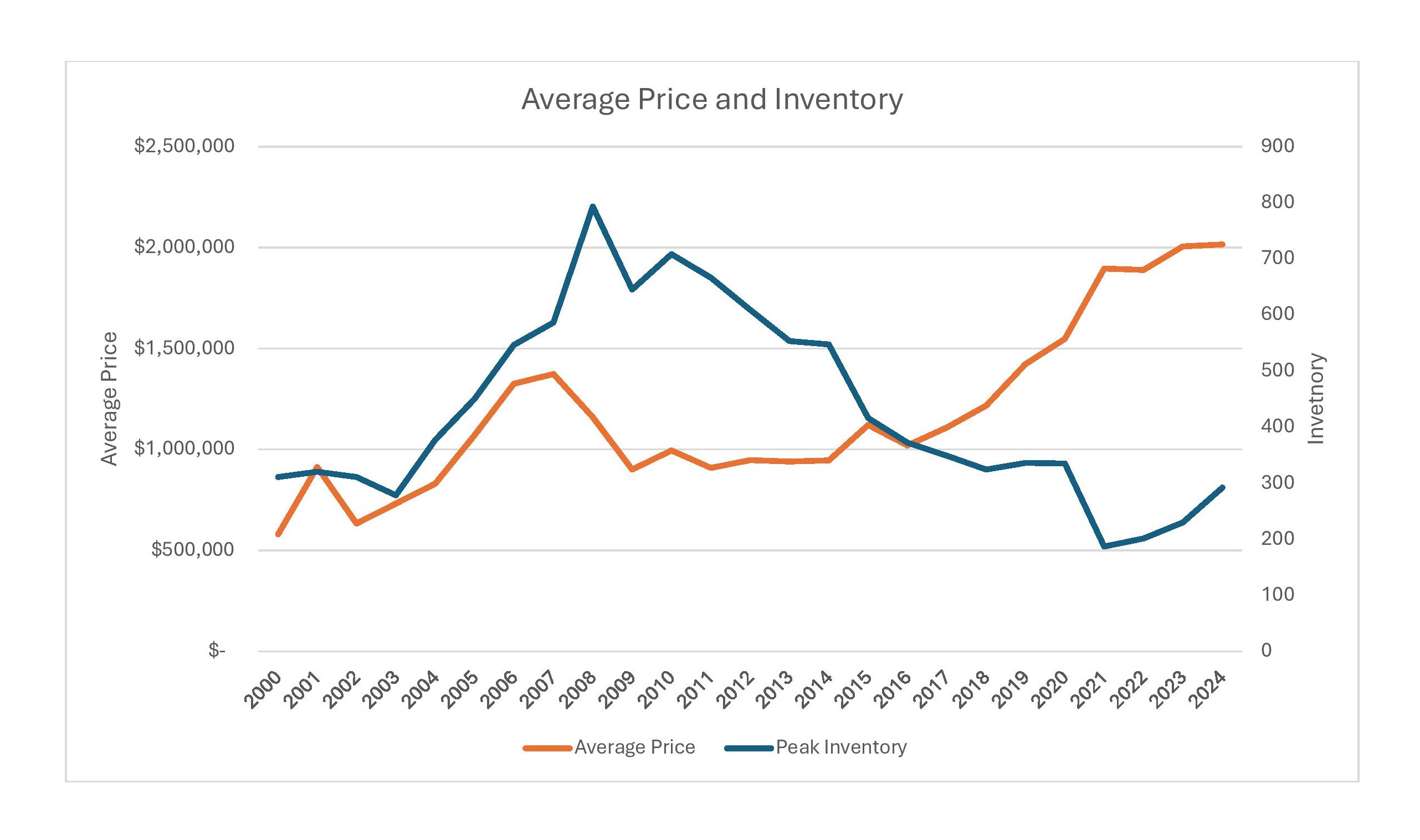

The two-year real estate boom on Martha’s Vineyard during 2020 and 2021 was driven by the COVID pandemic, low interest rates and high demand for Vineyard properties. During these years, the number of transactions soared and prices rose. The market slowed in 2022, however, as the number of transactions dropped dramatically and prices started to level off. 2023 continued this downward trajectory with the caveat of rising prices which rose 7% in 2023. 2024 continued downward activity and, this time residential prices were included, which may signal the official end of the COVID era in the real estate market on the island. It is important to note, that although residential prices softened a bit in 2024, the average price for residential property remains 35% higher than pre-COVID (average price for residential property in 2019 was $1.614mm, compared to $2.176mm in 2024).

The inventory level climbed in 2024 which is perhaps another marker of the end of the COVID era. Although inventory is still below average inventory levels pre-COVID, increased inventory in 2024 may have affected the lower average price of homes. Peak inventory level has been climbing since 2021 but the growth rate has been slow until 2024. Peak inventory jumped up to 292 properties in 2024. Prior to that, peak inventory in 2023 was 230 properties, 201 properties in 2022 and 187 properties in 2021. Peak inventory in 2019 (prior to the boom) was 527 properties, revealing that peak inventory in 2024 was still down more than 45% compared to pre-COVID levels but the pace of growth accelerated in 2024.

In these respects the Martha’s Vineyard real estate market mirrored the national housing market in 2024. “U.S. existing-home sales fell in 2024 to the lowest level since 1995, the second straight year of anemic sales” the Wall Street Journal reported. “The number of sales is also down about a third from the more than six million homes that sold in 2021, when the market was booming due to low mortgage rates and pent-up demand after the first year of the pandemic….Home prices have continued rising on a year-over-year basis, because the inventory of homes for sale is lower than historically normal levels. Inventory is up from year-ago levels, but supply is still tight in many markets because many would-be sellers with low mortgage rates are unwilling to sell and take on a higher rate to buy a different home.” (Wall Street Journal, January 24, 2025).

Meanwhile, the Martha’s Vineyard Average Days On Market (“DOM”) for sold properties hit its low point in 2024. The figures for Average DOM have seesawed in the past few years but have been moving generally in a downward trend. In 2020, when the real estate boom was just starting, average DOM for sold properties was 250 days. It dropped to 171 days in 2021 and 135 in 2022, then moved up to 154 in 2023. Average DOM in 2024 dropped to its lowest point of 117 days. It seems counter-intuitive that DOM fell in 2024 when total transactions decreased to the lowest level since 2009 and pricing remained high. Why are these sold properties moving faster? It may be that Sellers felt the shift in the market occurring and negotiated to make their sales close, and/or that Buyers have become more savvy about the market as they have waited for properties and were ready to make their moves when the right property emerged. Lower DOM doesn't mean everything sold - inventory is rising and some properties have been sitting on the market for well beyond the average 117 DOM which may mean that the pricing on these properties is out of line with value, there is an obstacle to overcome with the property or they are simply in a market niche that moves more slowly.

While properties moved more quickly in 2024, and prices remained at or near their all-time high, the entry level segment of the market under $1mm continued to be further squeezed. Only 25% of transactions occurred under $1mm in 2024 versus 31% in 2023. However, the highest end of the market also slowed, dropping off dramatically in 2024 with only 4 sales at $10mm+ versus 8 sales in 2023.

While the above statistics include all transactions and represent island-wide performance, individual towns and market segments reveal different dynamics. Martha’s Vineyard is an island with six towns, each with its own character and specific market conditions. Within each town there are different niches as well…waterfront, water view, high-end, mid-range, entry level and commercial properties. Generalizing trends or making broad statements is challenging because each market segment can be, on its own, very small. However, it is worth diving into the different towns and niches to understand their role in the overall market performance.

Chilmark posted 22 transactions in 2024, technically a 4.3% decrease from 2023 which had 23 transactions (and flat from 2022 which also had 22 transactions). This level of annual activity from 2022 to 2024 is the slowest for the town since 2009 and can be attributed to a lack of inventory. Chilmark’s inventory crept up in 2024 similar to the overall island market but still remains at an historic low. Chilmark’s peak inventory prior to COVID was 64 properties in 2019. It dropped to a low of 10 in 2022, then moved up to 17 in 2023 and 27 in 2024 (which is still 57% below pre-COVID inventory level).

A handful of high-end sales helped Chilmark post a 10% increase in dollar volume from $52mm in 2023 to $58mm in 2024 and a 15% increase in average price from $2.28mm in 2023 to $2.63mm in 2024.

Looking at Chilmark’s price segments specifically, the high end over $3mm revived in 2024 with 7 sales in this segment, compared to only 4 in 2023. This included the highest transaction up-island for 2024, a $7.65mm waterfront house, guesthouse and pool in Chilmark. Activity in the $1-3mm range dropped from 14 in 2023 to 10 in 2024. There was just one residential sale under $1mm in 2024, the same as 2023, and there were 3 beach lot transactions in 2024 (versus 4 in 2023).

In 2024, Chilmark sales represented 6% of transactions and 8% of dollar volume island-wide. The average home sale price in 2024 in Chilmark was $3.102mm, the highest of all the towns on the island in 2024.

West Tisbury transactions fell 14% from 50 transactions in 2023 to 43 in 2024. Dollar volume fell 13% from $99mm in 2023 to $86mm in 2023. But average sales price in the town climbed 1% from $1.98mm in 2023 to $1.995mm in 2024.

The market segment under $1mm slowed from 9 sales in 2023 to 5 in 2024. The mid-range of $1-3mm grew slightly from 30 sales in 2023 to 33 sales in 2024. The high-end over $3mm saw a decrease from 9 transactions in 2023 to 5 in 2024. West Tisbury had the highest land sale of the year at $7.6mm for a 12.6-acre parcel on Watcha Pond on the South Shore.

In 2024, West Tisbury sales represented 12% of all transactions on the island and 11% of dollar volume. The average home sales price in West Tisbury in 2024 was $2.04mm.

Aquinnah posted decreases in number of transactions and dollar volume in 2024 but an uptick in average price. Transactions were down 36% from 14 sales in 2023 to 9 in 2024 and dollar volume declined 17% from $23mm in 2023 to $19mm in 2024. However due to a few strong home sales and nonexistent beach lot sales in 2024, average price grew 30% from $1.66mm in 2023 to $2.16mm.

There were four land sales in Aquinnah in 2024, none of which were beach lots. Of the five residential sales, prices ranged from $1.79mm to $4.58mm.

This smallest market on the island represented 2% of total island-wide transactions and 3% of total island-wide dollar volume. The average home sale price in Aquinnah in 2024 was $3.098mm.

Edgartown’s fared well in 2024. The town’s performance was essentially flat with modest increases in dollar volume and average price. The number of transactions grew by one sale from 128 in 2023 to 129 in 2024. Total dollar volume grew by 2% from $350mm in 2023 to $358mm in 2024 and average price grew similarly 2% from $2.74mm in 2023 to $2.77mm in 2024.

Although high-end sales of $10mm+ slowed to three transactions in 2024, down from six sales in this price range in 2023, the segment of $3-10mm surged with 41 transactions in 2024 versus 26 in 2023. Edgartown had the highest real estate transaction on the island in 2024 – a $14.63mm sale of a waterfront, renovated antique home with 5 bedrooms on 1.5 acres.

Edgartown sales represented 34% of transactions and 47% of total dollar volume island-wide in 2024. The average home sale price in Edgartown in 2024 was $2.87mm.

In 2024, all market indicators decreased in Oak Bluffs. The number of transactions decreased 5% from 101 transactions in 2023 to 96 in 2024, dollar volume fell 11% from $144mm in 2023 to 128mm in 2024, and average price fell 7% from $1.423mm in 2023 to $1.330mm in 2024. The market segment under $1mm dropped from 45 transactions in 2023 to 39 in 2024, causing the median price to rise, from $1.1mm in 2023 to $1.14mm in 2024.

Oak Bluffs’ transactions represented 26% of transactions on the island in 2024 and 17% of dollar volume. The average home sale price in Oak Bluffs in 2024 was $1.39mm, which is the lowest of all the towns.

Tisbury reported an 18% decline in the number of transactions from 91 in 2023 to 75 in 2024, a 20% decrease in dollar volume from $147mm in 2023 to $118mm in 2024, and a 3% drop in average price from $1.62mm in 2023 to $1.57mm in 2024.

The highest sale for the town in 2024 was a $12mm transaction for a 1.7-acre parcel with a 6500 square foot home, waterfront on the harbor with sandy beach and a pool. This was one of only four transactions $10mm+ in 2024 (the other three were in Edgartown). Tisbury also had the highest commercial sale - $8.7mm for a property straddling both sides of Beach Road with multiple buildings and over 10k square feet of commercial space.

Tisbury represented 20% of transactions and 15% of dollar volume island-wide in 2024. The average home sale in Tisbury in 2024 was $1.61mm.

Given the market conditions discussed above, it’s no surprise that the entry level segment of the market, all sales under $1mm, continues to decline. The total number of sales under $1mm dropped from 298 in 2021 to 169 in 2022 to 132 in 2023 and down to 94 in 2024. The segment decreased from a market share of 42% of all transactions in 2021 to 36% in 2022 to 32% in 2023 and down to 25% in 2024. For buyers in this segment, including local families and service workers, it continued to be more difficult to enter the island real estate market, and the challenge is compounded by relatively high mortgage rates.

As the housing crisis for local families and workers continues, the effects of this crisis can be felt throughout the Vineyard community. We are losing young, creative people. We are losing friends and neighbors who move off island where they can afford to buy homes. We are losing businesses. Essential services are harder to come by as are the amenities which power our economy. Labor shortages are an ongoing reality.

Local individuals, governments and organizations continue to chip away at this monumental issue, changing zoning by-laws, increasing rent subsidies and building new affordable housing. As of this writing (Jan 2025), Island Housing Trust now has 149 units of approved new rental and ownership housing in its pipeline and in August 2024, Governor Maura Healey and the Massachusetts legislature enacted the Affordable Homes Act for Massachusetts.

The Affordable Homes Act provides $5.1 billion in funding opportunities over the next five years to affordable housing initiatives throughout Massachusetts and also expands tax credits and incentive programs. It includes a new designation category of “Seasonal Communities”, for which Martha’s Vineyard qualifies, “to recognize Massachusetts communities that experience substantial variation in seasonal employment and to create distinctive tools to address their unique housing needs.” https://www.mass.gov/info-details/seasonal-communities

Another provision in the Affordable Homes Act allows property owners in single family zoning districts to build Accessory Dwelling Units (ADUs) up to 900 square feet by-right. As of February 2, 2025, property owners throughout Massachusetts have the option to add a new rental apartment in their home or on their property. Individual towns may restrict these units so that they are not used for short-term rentals and the towns may impose “reasonable restrictions and requirements” regarding Title 5 septic systems, site review, bulk, height and setbacks. As of this writing (January), the state is in the process of issuing Model ADU Zoning for cities and towns to help them develop and/or amend local ADU rules. We will see how the towns on the island implement this new law in the months and years to come and what impact it will have. https://www.mass.gov/info-details/accessory-dwelling-units

The Coalition to Create an MV Housing Bank observes that there was “significant housing progress” in 2024, but it is “nowhere near enough”. The proposal for a Martha’s Vineyard housing bank was approved with landslide majorities in all six towns on the island in 2022 and this effort continues despite not being included in the Affordable Homes Act last year. Endorsed by many businesses and community groups including Tea Lane Associates, this proposal would implement a transfer tax on real estate transactions on Martha’s Vineyard to create a fund for affordable housing. The money would go both towards rentals and towards creating stable property ownership for local workers and families. https://www.ccmvhb.org/

The results for high-end sales in general revealed a slowdown like the overall market. All segments of the high-end slowed except for $3mm+ which grew slightly from 63 sales in 2023 to 67 sales in 2024. The category of $5+mm sales fell from 25 transactions in 2023 to 22 in 2024. $7+mm sales decreased from 12 transactions in 2023 to 9 in 2024. And finally, the luxury high-end $10+mm dropped sharply from 8 transactions in 2023 with two of those over $20mm to 4 transactions in 2024 with the highest price of $14.63mm.

In 2024, the $3+mm segment of the market represented 46% of total island-wide dollar volume (flat from 46% in 2023 and 2022) and 18% of all transactions (up from 15% in 2023).

There were four transactions in the $10+mm category on the island in 2024. They included a 5600 square foot, 5-bedroom house on 1.5 acres with pool near South Beach in Edgartown for $10mm, a 6500 square foot 5-bedroom house on 1.7 acres with pool on the Vineyard Haven harbor for $12mm, a 3500 square foot, 8-bedroom antique home on Edgartown harbor with deep water dock for $13.128mm, and a 4400 square foot, 5-bedroom home on 1.5 acres on Nantucket Sound in Edgartown for $14.625mm.

Sales of vacant buildable parcels leveled off after two years of decline – this segment declined 23% from 100 transactions in 2021 to 77 in 2022, then decreased again by 30% to 54 in 2023 but remained flat in 2024 with 54 transactions. Dollar volume of land sales dropped 17% from $87mm in 2022 to $72mm in 2023 and dropped another 5% in 2024 to $68.5mm. These buildable land sales represented 14% of all transactions on the island in 2024.

Looking at high-end land sales, there were four transactions of $3+mm in 2024 (versus six sales in this category in 2023). Of these four transactions, three of them were on Chappy and part of one large transfer, including other parcels, to the Land Bank. The other transaction was a private sale of a 12.6-acre parcel on Watcha Pond in West Tisbury near the South Shore with multiple house sites and elevated views of the pond out to the ocean, for $7,600,000.

Average price of buildable parcels decreased from $1.333mm in 2023 to $1.267mm in 2024. Median price rose from $800,000 in 2023 to $867,500 in 2024.

Beach Lots represent a separate segment of land sales. These are unbuildable properties which convey ownership in private beaches on the island. This segment decreased to 3 transactions in 2024, down from 8 in 2023. These three beach lot sales were all in Chilmark in 2024 and ranged from $420,000 to $430,000. It is impossible to hypothesize about this market segment because inventory drives it and the availability of these properties is erratic and unpredictable.

The sale of commercial properties decreased from 22 commercial transactions in 2023 to 15 in 2024. Of the 15 commercial transactions in 2024, 7 were in Tisbury, 5 were in Edgartown, and 3 were in Oak Bluffs. The highest priced commercial transaction was the $8.7mm sale of a property straddling both sides of Beach Road in Vineyard Haven with multiple buildings, some waterfront, and over 10k square feet of commercial space. This included the West Marine building on Beach Rd and the buildings of the Garde East restaurant.

Conclusion

The 2024 Martha’s Vineyard real estate market gave a clearer picture of where we are headed. It was another year marked by slow activity but this time prices began to stabilize and inventory started to grow. It seems we are seeing a slow shift in the Martha’s Vineyard market. The Seller’s market dynamic, front and center since the COVID pandemic, has begun to weaken. While this should give Buyers some optimism, as long as prices remain high, Sellers are still in a stong position.

The future remains uncertain. Some predictions for the national housing in market in 2025 follow: “Realtor.com is predicting that mortgage rates will hover around 6.3 percent through next year while Redfin expects them to stay closer to 7 percent, keeping many prospective buyers on the sidelines….Redfin, expecting that demand will continue to outpace supply, predicts prices will rise by 4 percent next year, while CoreLogic, expecting that high interest rates will deter more buyers, forecasts a more modest 1.9 percent growth….Sam Kater, chief economist at Freddie Mac, projects that prices will rise faster than they did in 2024, but sales will still increase as buyers come to terms with how far their dollars will go. ‘Home buyers will adjust what they’re looking for,’ he said.” (New York Times, December 11, 2024).

“Zillow’s economists forecast a slight increase in home sales and more modest home price appreciation in 2025…A housing market in the doldrums has been hurt by volatile mortgage rates, but a severe shortage of available homes is the most critical obstacle of would-be buyers, Zillow Group Chief Executive Jeremy Wacksman said. ‘Homes are just not trading nearly as much as they could, which contributes to making it tougher for buyers’. Zillow estimates the U.S. housing market is short by about 4.5 million homes. Regulatory hurdles and other obstacles to development at the local level stymie growth in home supplies, and many areas are struggling to make housing affordable. New challenges may arise if President Trump fulfills pledges to raise tariffs and removes millions of undocumented immigrants, many of whom work in construction. ‘Not to oversimply, but you really can boil the housing affordability crisis down to an availability crisis’ Waksman said. ‘Getting more homes available is going to be ultimately what starts to unstick the housing market.’” (Wall Street Journal, Jan. 23, 2025)

As we mentioned last year, housing is more than just an economic asset. Whether you are considering a seasonal vacation home or a year-round property, you are likely thinking about family and friends, what the Vineyard offers, where you are in your own life cycle, what you are looking forward to and what you would like to change. There are many reasons people choose to buy or sell at any moment in time. For those who can afford it and have waited on the sidelines for the market to improve, 2025 may be the time to jump in and move forward. For Sellers, prices may not continue to appreciate as they have in the last few years so it may not benefit you to wait. For Buyers, more inventory and negotiating power should be accessible in 2025 but keep in mind that Average Days on Market decreased in 2024 so there is, as always, competition from other buyers for desirable properties that are also well priced.

If you are thinking of selling or buying real estate on the island, it is important to consult with your agent to better understand the market specific to your needs, and strategize so that you can move adeptly as the opportunity arises.

National and world events will continue to affect our local economy, for good or bad. With the new administration, one war continuing and another on a temporary ceasefire, there is never any certainty what will happen in the year to come. But the Martha’s Vineyard real estate market is solid and the draw to the slower, quieter, simpler life the island offers is as strong as ever. We remain optimistic about the year ahead for buyers and sellers alike.

KEY MARKET STATISTICS

TEA LANE ASSOCIATES' YEAR-END HIGHLIGHTS 2024

Tea Lane Associates sold property in all six towns in 2024 and represented the buyer and/or seller in the three highest sales in Chilmark including the highest transaction up-island in 2024. Tea Lane sold three of the five residential sales in Aquinnah, and five of the top ten sales in West Tisbury including the two highest sales.

Tea Lane Associates advised the Sellers in the highest priced vacant land transaction on the island in 2024.

Tea Lane Associates sales included five of the top 20 brokered sales island-wide in 2024.

Tea Lane Associates’ sales represented 46% of Chilmark dollar volume, 41% of Aquinnah dollar volume, 39% of all up-island dollar volume, and 12% of dollar volume island-wide.

Tea Lane Associates represented buyers and sellers at all price points. We worked with buyers who have been coming to the Vineyard for their lifetime and buyers who discovered the island more recently, with buyers who were upgrading on the island, buyers who were downsizing and with buyers who were expanding their holdings on the island. We helped families purchase their year-round homes, and buyers who were setting up for retirement. We worked with sellers (individuals, groups of family members, trustees, business partners) to list and sell a wide range of properties from vacant land, to new construction, to beloved generational family homes. All are an important part of what we do and we were honored to be part of a new chapter in our clients’ lives.

In 2024, Tea Lane Associates affiliated with Forbes Global Properties, a brokerage owned and Invitation-only international marketing network. As an independent agency with over 55 years of experience and deep roots in the Martha’s Vineyard community, Tea Lane Associates enhanced its local roots with global reach for our clients. Tea Lane exclusively represents Martha’s Vineyard in the Forbes network of print, digital, and social media channels, engaging an audience of more than 140 million. Forbes Global Properties connects buyers and sellers of luxury properties worldwide and is the exclusive real estate partner of Forbes, one of the world’s most trusted media brands.